Funding for Garages and MOT Businesses

How much money does your Garage business need?

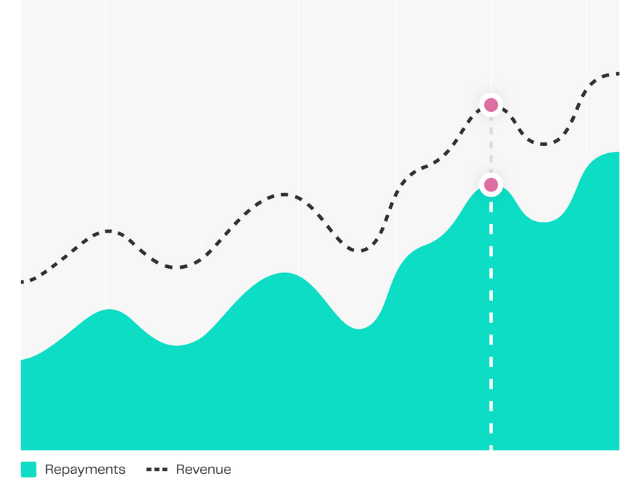

£60,000

funding received

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

Garage and MOT Business Finance Made Simple

Maintaining consistent cash flow can be a problem for small business owners, particularly in the motor vehicle industry. That’s why finding suitable funding solutions is imperative for any UK-based garage and MOT business.

Getting business finance through a Rev&U™ cash advance could be an ideal alternative to traditional bank financing. A cash advance is a financial solution tailored to garage and MOT businesses that offers quick capital to help you pay business bills, manage suppliers, and boost cash flow.

How Garage and MOT Businesses have Benefitted from Rev&U™

- Purchasing stock, car parts or diagnostic equipment

- Installing new ramps or service bays

- Running marketing campaigns

- Increasing working capital

Our Customers’ Stories

About our Rev&U™ Business Funding

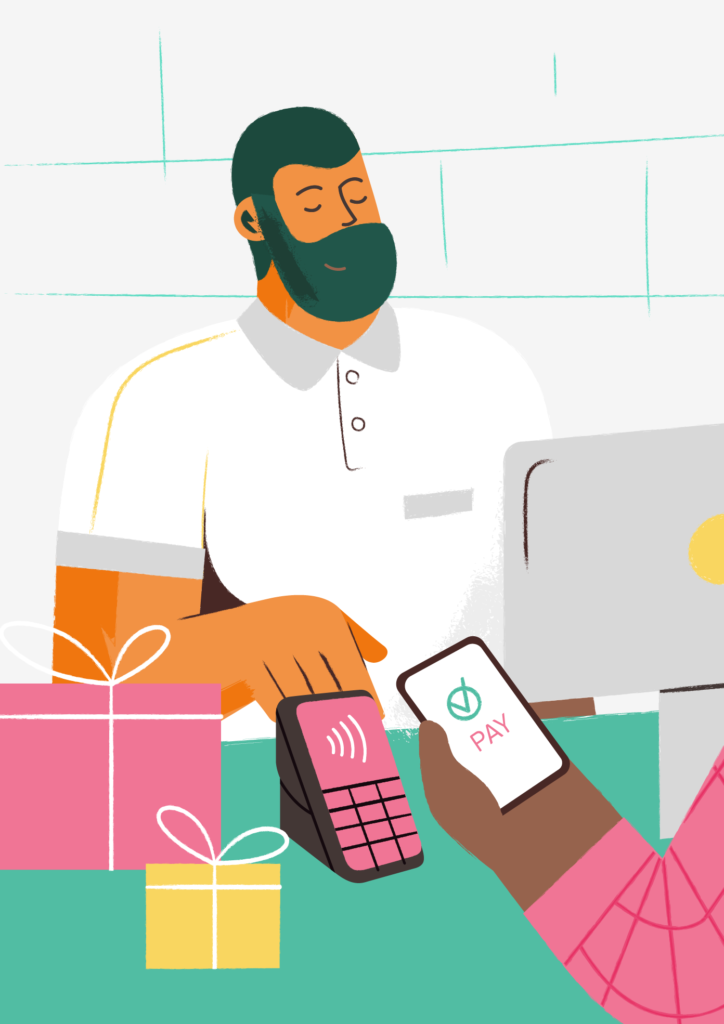

To be eligible for Rev&U™, a business owner needs to transact through a debit or credit card machine. There is no fixed term or minimum repayment, just a single fee agreed up-front.

Whether you’re looking for funding for your business, or to partner with us as a broker or introducer, our friendly team would love to hear from you!

Am I eligible for a Rev&U™ Cash Advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible!

Get a QuoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a Callback

Accelerating Growth on All Types of Businesses

Finance Academy

Explore our in-depth guides to help business understand 365 finance.