eCommerce Business Finance

How much money does your eCommerce business need?

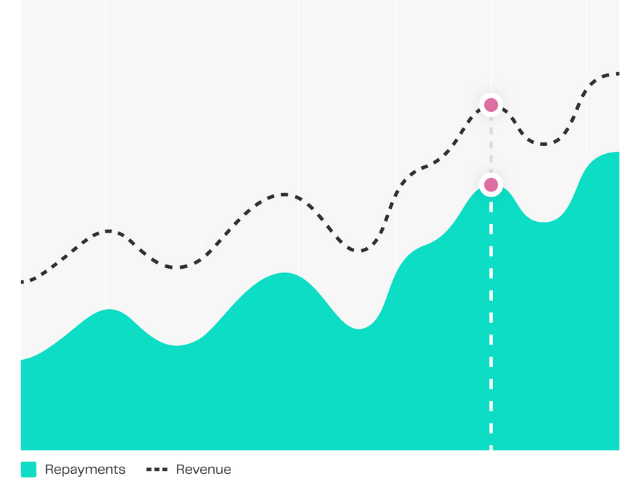

£60,000

funding received

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

eCommerce business loans made simple

Maintaining consistent cash flow can be a problem for small business owners, particularly in the eCommerce industry. That’s why finding suitable loan products is imperative for any UK-based eCommerce business.

Securing business finance through a Rev&U™ cash advance could be an ideal alternative to a traditional bank loan. A cash advance is a type of eCommerce business loan that offers quick capital to help you pay business bills, manage suppliers, and boost cash flow.

How eCommerce Businesses have Benefitted from Rev&U™

- Renting more office space and hiring new staff

- Paying for web design and development

- Improving current service and product offers through inventory financing

- Running marketing campaigns

- Increasing working capital

- Improving infrastructure regarding customer support, order handling etc.

Our Customers’ Stories

About our Rev&U™ business funding

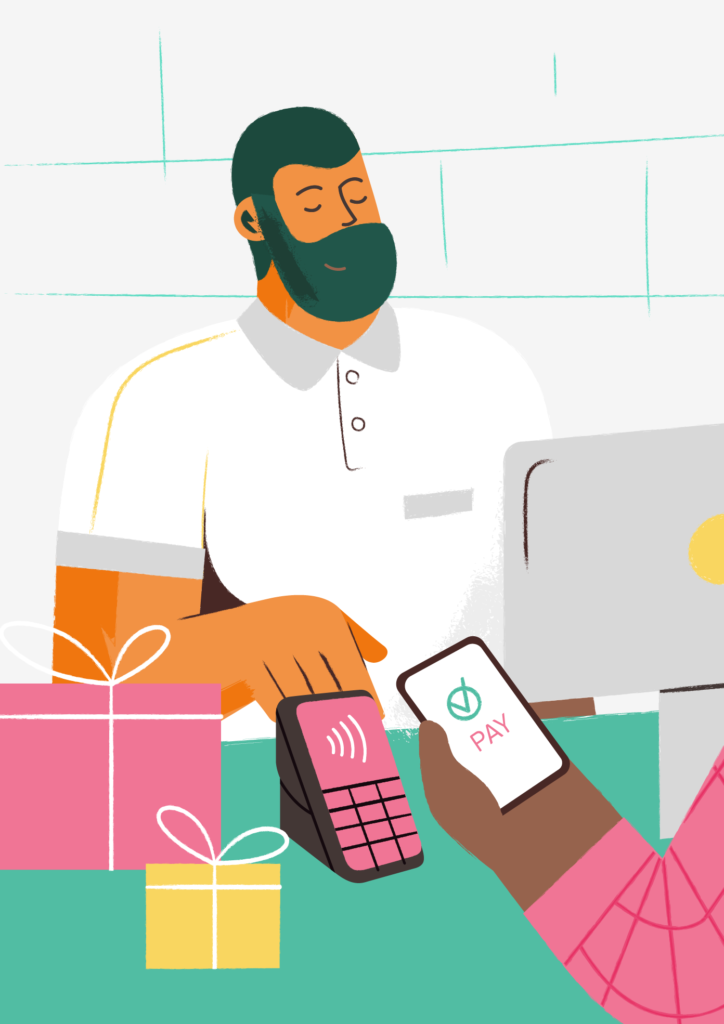

To be eligible for Rev&U™, a business owner needs to transact through a debit or credit card machine. There is no fixed term or minimum repayment, just a single fee agreed up-front.

Whether you’re looking for funding for your business, or to partner with us as a broker or introducer, our friendly team would love to hear from you!

Am I eligible for a Rev&U™ cash advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible!

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callback

Accelerating growth on all types of business

Finance Academy

Explore our in depth guides to help business understand 365 finance.