Restaurant Business Finance

How much money does your restaurant business need?

£60,000

funding received

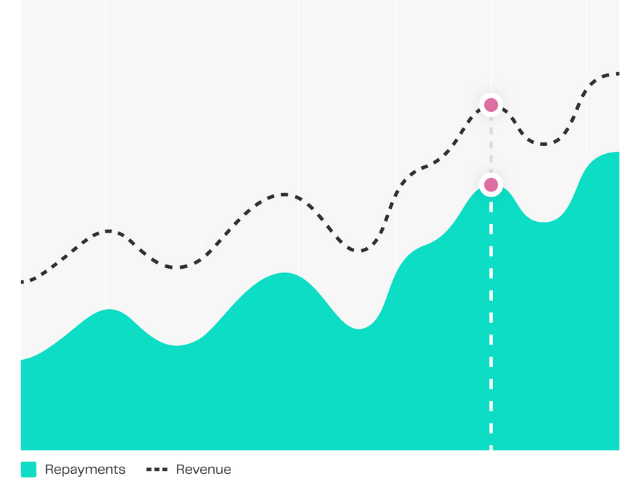

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

Restaurant Business Finance Made Simple

Maintaining consistent cash flow can be a problem for small business owners, particularly in the restaurant industry. That’s why finding suitable funding solutions is imperative for any UK-based hospitality business.

Securing business finance through a Rev&U™ cash advance could be an ideal alternative to traditional bank financing. A cash advance is a financial solution tailored to restaurants that offers quick capital to help you pay business bills, manage suppliers, and boost cash flow.

How Restaurant Businesses have Benefitted from Rev&U™

- Refurbishing and expanding

- Purchasing the lease of a premises

- Running marketing campaigns

- Increasing working capital

- Purchasing equipment like walk-in freezers, coolers, ovens, or fryers

Our Customers’ Stories

About our Rev&U™ Business Funding

To be eligible for Rev&U™, a business owner needs to transact through a debit or credit card machine. There is no fixed term or minimum repayment, just a single fee agreed up-front.

Whether you’re looking for funding for your business, or to partner with us as a broker or introducer, our friendly team would love to hear from you!

Am I eligible for a Rev&U™ Cash Advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible!

Get a QuoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a Callback

Accelerating Growth on All Types of Businesses

Finance Academy

Explore our in-depth guides to help business understand 365 finance.