Revenue-Based Financing

Quickly raise funding for your business and only repay when your customers pay you.

Raise between

£10,000 & £400,000

Over

90% approval

Approval within

24 hours

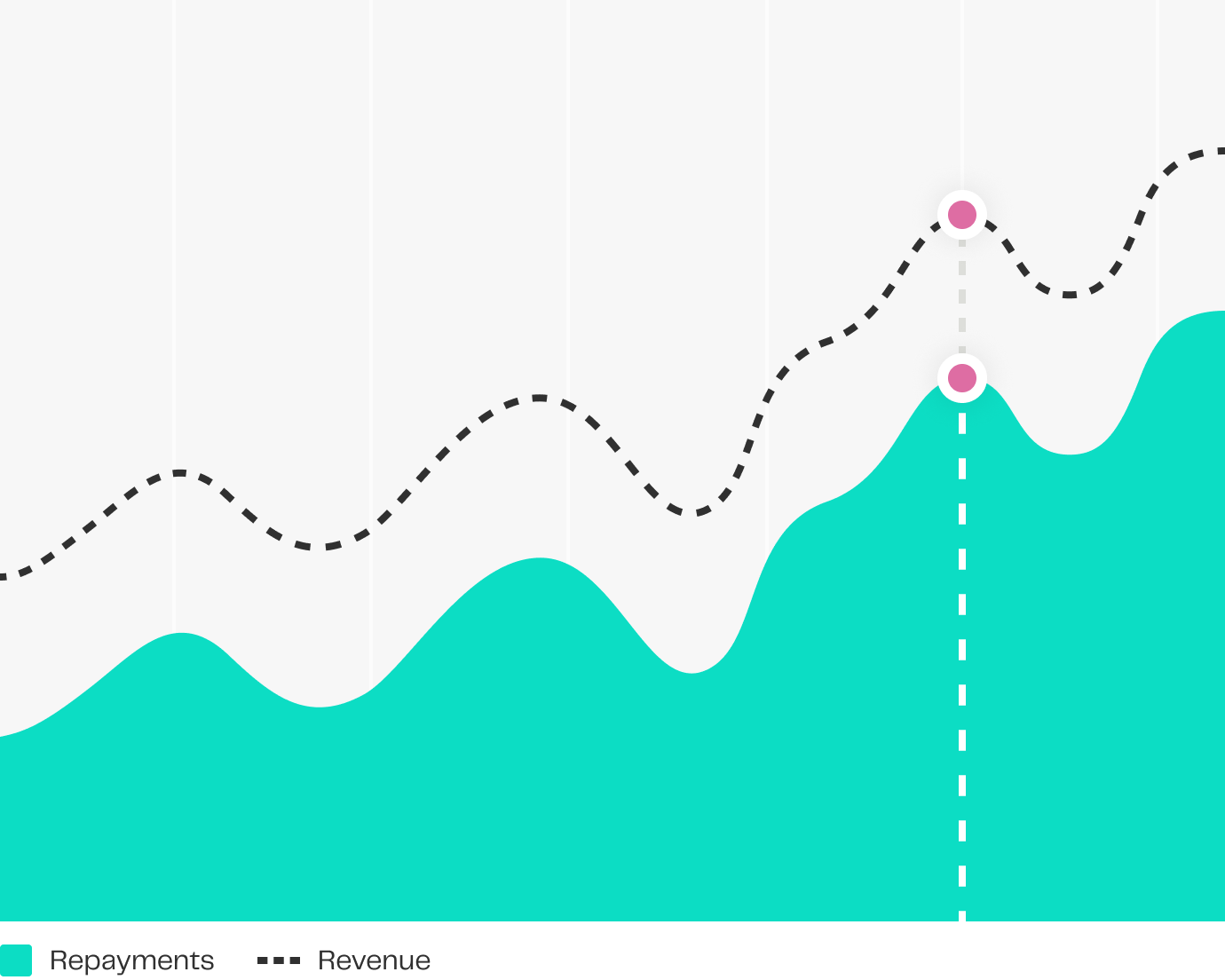

Unlike a traditional loan, repayments mirror the ups and downs of your business.

Repayments are automatic and based on a small percentage of your monthly card sales. So when business is slow, repayments are low – and when business is good, you pay a bit more. Not only does this remove the stress of a traditional high street loan, it is also perfect for seasonal businesses.

How Rev&U™ repayments work

1

Agree fixed percentage

We agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales).

2

Make card sales

You sell to your customers on your credit and debit card terminals as usual.

3

Repay automatically

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale.

4

Receive money in your account

There is no change to the time it takes for you to receive the remaining money from your sales.

5

Reduce balance outstanding

The daily amount deducted reduces the balance outstanding on the cash advance.

6

Stop automatically

Collections stop automatically once the cash advance has been repaid in full.

Am I eligible for revenue-based financing?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callbackHow much capital does your business need?

Use our calculator and see how revenue-based financing could help your business:

£60,000

funding received

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

A simple and secure way to finance your business

Quick application process

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval in under 24 hours

Find out in up to 24 hours whether you’ve been approved or not.

Get your cash advance in days

Receive the funds direct into your business bank account within days.

Useful information

Frequently asked questions

Rev&U™ is a form of revenue based funding that enables you to quickly and easily raise between £10,000 and £400,000. Unlike a regular bank loan, there are no fixed monthly payments – you simply pay back a small percentage of your credit and debit card sales, meaning you only pay us back when your customers pay you.

There are no APRs, admin charges or late fees. So if you’re having a quiet month, your repayments automatically reduce, which helps you manage your cash flow.

We’ve designed our funding process to be fast, simple and hassle-free. This means you don’t need to supply business plans or security for revenue based funding. Once funded, the processing of repayments happens automatically, so there is no disruption to your business.

You can apply in minutes, with approval within 24 hours (and a 90% approval rate). No security or business plans are required and flexible repayments are based on your card sales.

Unlike a bank loan, there are no fixed weekly or monthly repayments; you simply pay back a small percentage of your credit and debit card sales. This means that, during a seasonal dip in sales, your repayments will go down to match the decreased in sales – so your cash flow remains stable.

Finance Academy

Explore our Finance Academy to understand all the financial acronyms and jargon, and take charge of your business’s financial success today!

Explore our guides