Understanding The Debt Service Coverage Ratio

Written by Team 365 Finance

Before investing money in a business or providing a loan to someone, a responsible lender or investor will take steps to find out the level of risk involved. One of these steps is likely to be calculating the debt service coverage ratio, also referred to as the DSCR. In this article, we’ll explain what the DSCR is, as well as providing the debt service coverage ratio formula and demonstrate how to calculate the debt service coverage ratio.

Additionally, we’ll look at the benefits and disadvantages of using the ratio, and how you can ensure your business can improve its DSCR. This is crucial, as a good DSCR might be the difference between your company receiving a crucial loan or being passed over for financial assistance. As 365 Finance CFO Adam Brown says:

The DSCR is a critical ratio for any business supported by financing arrangements. Close monitoring can demonstrate disciplined cash management, and ensure early communication with lenders where issues are foreseen. Maintaining healthy headroom on debt service costs can be critical for attracting new forms of capital.

Adam Brown , CFO

What is the Debt Service Coverage Ratio?

Put simply, the debt service coverage ratio measures a company’s ability to repay its debts in full and on time. Calculating the ratio involves looking at the cash flow of the business — if there is a considerable amount of cash coming into the company, and a low amount going towards various expenses, then it’s likely that the company will be able to easily pay back any debts.

Calculating the debt service coverage ratio requires the use of a particular formula that compares cash flow to overall debt. Because it analyses a business’s cash flow, the ratio is a good indicator of overall financial health and works well as a tool to judge a business’s suitability for loans.

3 Examples of How the Debt Service Coverage Ratio Is Used

There are multiple ways that the debt service coverage ratio can be applied in a practical business context. Below, we’ve listed some of the more likely uses of the DSCR that you might encounter.

1. Lending Assessments

The most common application of the debt service coverage ratio is when it’s used by lenders to measure a company’s ability to repay a loan. The DSCR is a highly effective tool for this because it checks the company’s cash flow against the principal amount of the loan and the expected interest the loan will accrue.

2. Investor Reviews

Lenders (such as banks) use the DSCR to ensure that they’re not lending money to a business that will fail to afford repayments, as this would lose them money. Investors use the DSCR in a similar fashion — a company with a low DSCR is likely a risky prospect for investment. The ratio also compares income to expenses, giving investors a solid idea of the dividends they may receive from the business.

3. Internal Business Analysis

Calculating your DSCR helps you understand the financial health of your business, so the ratio can be used as part of your internal business discussions to help plan out a financial strategy. In particular, the DSCR is useful because it provides a concrete number that can be brought out to help decide whether you can afford to apply for a loan or to identify how much of your income is going towards paying off existing debt.

How Would Lenders Use The Debt Service Coverage Ratio?

The debt service coverage ratio shows how healthy a company’s cash flow is, specifically how it stands up when compared against a new source of debt. This is what the name of the ratio refers to — ‘debt service’ is the amount of money needed to repay a loan (plus interest) within a given time period, and the ratio checks if the company’s cash flow can cover this amount.

As such, the DSCR is hugely useful to lenders, who primarily use it to determine how likely a business is to qualify for a loan. A company with a high DSCR is a low-risk borrower and should be able to repay a loan without issue. A business with a low or negative DSCR has significant cash flow issues, so most lenders would likely refrain from providing funding.

As well as calculating a business’ debt service coverage ratio prior to lending money, most lenders will routinely calculate a borrower’s DSCR while the loan is being repaid. Poor economic conditions or low-income periods might cause their DSCR to dip, which tells the lender that the borrower may struggle to keep up with future payments.

Advantages and Disadvantages of the DSCR

There are advantages and disadvantages to using the DSCR as a business analysis tool. Below, we’ve listed a few of the benefits of using the DSCR, as well as drawbacks that you should be aware of.

Advantages

- As we mentioned above, most lenders will consistently calculate a borrower’s DSCR for the duration of a loan to keep track of their ability to repay. A key advantage of the DSCR is the value it offers when it’s consistently calculated: it offers a simple and accurate barometer for financial health. Looking at your DSCR as it changes over the financial year allows you to identify cash flow trends and predict your financial future.

- The DSCR is easily calculated with minimal information, and there are multiple options available (the debt service coverage ratio formula can use EBITDA, EBIT, or net income) if any information is missing.

- If you have the required information, you can calculate and compare your debt service coverage ratio to that of your competitors. This helps you estimate how efficient it would be for a company in your industry to use a loan to fund growth.

Disadvantages

- The debt service coverage ratio formula compares cash flow to the principal loan amount plus interest, but no standardisation exists for the amount representing your cash flow. Lenders might use operating income, net operating income, EBIT, or EBITDA when assessing your business. As such, your DSCR can be inconsistent or misleading when calculated by different external entities.

- If operating income, EBIT, or EBITDA are used to represent cash flow in the DSCR formula, your company’s income can be exaggerated because not all expenses are being considered. Specifically, none of the three amounts mentioned include taxes. If a lender calculates your DSCR in a way that overstates your revenue, it can lead to your business receiving a loan that you’re unable to pay back.

- The DSCR requires adjustments for non-cash expenses like the depreciation of assets because it’s primarily based on a company’s cash liquidity. As such, businesses that base their worth on their assets may find the DSCR inaccurate or less useful.

How Do You Calculate the Debt Service Coverage Ratio?

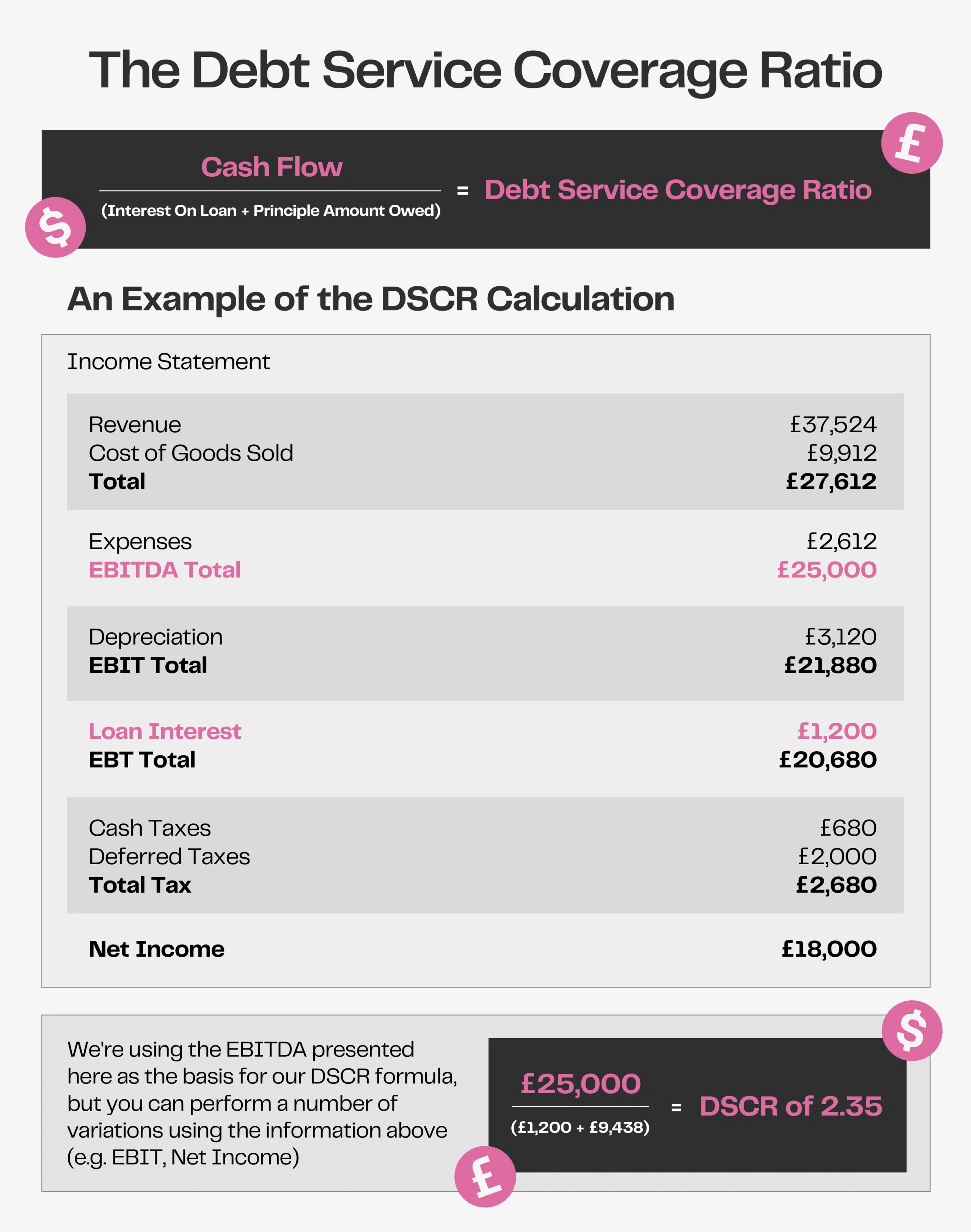

While there are a lot of factors to consider when calculating the DSCR, the formula itself is essentially simple division. All a business needs to do is divide its cash flow by the total value of the loan (i.e. the principal amount plus interest). This provides a single-digit number, which is usually rounded to two or less decimal places.

As we mentioned above, there is no standardised figure from your financial documents used to represent cash flow in the debt service coverage ratio formula. EBITDA, EBIT, operating income, or net operating income can all be used.

Below, we’ll demonstrate how to calculate the debt service coverage ratio using an example of a standard business income statement:

What’s A Good DSCR For A Business To Have?

The DSCR usually provides businesses with a single-digit number. In general, the higher this number is, the better. The closer your DSCR is to 1, the more likely it is that your business will be passed over for loans and external investment.

Specifically, a DSCR should be at least 1.25 or higher. This is the minimum DSCR that most lenders will be looking for, but that requirement changes depending on the business loan in question and which lender is providing the funding. However, it’s important to note that a DSCR of 1.25 is an absolute minimum — a ratio of 2 or higher is much healthier.

If your DSCR is 1, it means all of your cash flow (this could be your EBITDA, EBIT, or operating income, depending on which amount was used in the debt service coverage ratio formula) is going towards paying off debt and expenses. Your business is making no profits, and (if EBIT or EBITDA was used) there is no money left over to pay taxes.

A negative DSCR is even worse, as it means the business is actively losing money and cannot afford to repay the loan within the given period. For example, a DSCR of 0.95 means there is only sufficient net operating income to cover 95% of annual debt payments.

Lenders and investors will all have different standards for the DSCR. Some investors may see a business with a DSCR of 1.25 as a hugely risky investment, whereas others may leap at the opportunity. Additionally, some lenders and investors may see a company’s current DSCR as a set number, while others will take into account temporary factors affecting the ratio.

How Can Businesses Improve Their Debt Service Coverage Ratio?

As the debt service coverage ratio reflects your cash flow, improving means you need to increase your income while minimising your expenses. However, this can be a difficult task in practice. The best strategies may also be particular to you, as cost-cutting and revenue-boosting measures will differ significantly depending on your industry.

That said, some universally applicable tactics can help improve your DSCR. For example, lowering your energy usage to reduce your outgoing expenses is something every company can try. Negotiating lower prices from suppliers while increasing your own selling price can also help (although increasing prices may drive down business in the long run, harming your cash flow).

Generally speaking, the aim is to optimise operational efficiency so as much money is made as possible while spending as little as you can. If you can achieve this while maintaining adequate financial management practices, your DSCR should improve.

While these strategies impact the top half of the debt service coverage ratio formula, there’s also the bottom half to consider. It’s important to manage your debt (and the associated interest) to maintain a healthy DSCR. One tactic is to fully refinance your debt in order to receive more favourable repayment terms. While this won’t affect the principal amount you have to repay, it may result in lower interest rates.

You should also take your cash flow into account when you’re considering applying for a loan. If you know you’re heading into a low-income period — for example, if you run an ice cream parlour and summer is about to end — you may want to refrain from acquiring new debt sources.

Finally, when you’re looking for funding, try to access options that are low-risk and offer convenient repayment options. Revenue-based finance is a key example of this type of funding.

Do You Need Easily Accessible Funding?

Your DSCR may be a key indicator of whether you receive funding or not, but before you worry about your ratio, make sure you identify the right source of funding first. For many small businesses across the UK, revenue-based finance from 365 Finance is their best financial solution.

At 365 Finance, we offer revenue-based funding through Rev&U. This innovative funding solution allows businesses to quickly and easily access significant amounts without having to have a perfect credit score or a well-developed business plan.

Additionally, the repayments for revenue-based funding are much easier to manage than those of a traditional bank loan. Repayments are calculated based on your business income, and small repayments are taken each day from any debit or credit card payments you process. So, you don’t need to worry about unaffordable repayments at the end of each month.

At 365 Finance, we can provide both long and short-term financial solutions, with revenue-based funding available from £10,000 to £400,000 in capital. Apply for Rev&U today without affecting your credit score, or speak to our team to find out how we can help your business. To find out more, head to our website.