How 365 finance Have Supported Brokers in 2024

Written by Team 365 finance

2024 has been a record year of growth here at 365 finance as we continue to empower businesses across the UK with flexible financial solutions. Despite ongoing economic challenges, we’ve expanded our scope, made a record number of deals, and provided tailored funding to thousands of SMEs–which we couldn’t have done without the help of our network of brokers.

This year, we made 4,117 deals, predominantly to fund retail businesses, restaurants, and bars. Let’s examine 2024 in more detail.

Financial Lending in 2024

Running a small business in the UK isn’t easy, especially over the past few years. The funding situation still hasn’t returned to pre-pandemic levels, but things are starting to improve with a range of Government schemes and alternative financial solutions, like revenue-based funding.

Already, 20% of new businesses fail within their first year of operations, but global situations like the pandemic added fuel to the fire of running a business. 45% of SMEs said their turnover fell by at least 20% during the period. Although the pandemic may seem a while ago now, many SMEs are still feeling its effects, which we’ve seen throughout 2024.

Now, with Government schemes like the Regional Investment Zones Programme and well-established schemes such as the Start-Up Loans Programme, we’re starting to see an environment that is better for small businesses.

Overview of 365 finance in 2024

2024 has been a record-breaking year for us. We made a total of 4,117 deals and increased our total amount advanced by 11% compared to 2023. Our main financial highlights include:

- Funding 2,000 more businesses in the UK than last year

- Collaborating with strategic partners, introducers and referral channels for 85% of our funded deals

- Helping businesses across the UK, with London, the Southeast, and the Northeast leading the way.

- Maintaining a 80% renewal rate and building lasting relationships with our clients.

Why Brokers Choose Us

We work closely with more than 250 brokers nationwide who refer 60% of the deals that come through our doors.

One of our biggest goals is to create long-term relationships with brokers, which is working: we have a 70% renewal rate. Stronger relationships mean better support for brokers and allow us to provide more tailored support to ensure you’re making the best deals for your clients.

Not only do we provide first-class support to our brokers, but we are also leading the way in supporting the wider community and bringing innovative finance solutions to our clients. This was demonstrated by the launch of our yearly #SheLeads campaign, where we empower female-led businesses. This campaign comes at a time where only 2p of every £1 of investment in the UK goes to female-led companies, and only 1 in 5 active businesses are run by women.

We’re also a multi-award-winning business, collecting awards from the following award ceremonies throughout 2024:

- Credit Strategy Lending Awards

- NACFB Commercial Lender Awards (Shortlisted)

- King’s Award for Enterprise in Innovation

- Credit Awards

- Women in Credit Awards

- Lending Awards

Things go beyond finances for us; we also received Carbon Neutral certification in 2024. This year, we doubled down on our goal to reduce our climate footprint through using renewable energy, reducing travel, implementing electric vehicle schemes, and more.

If you want to work with a lender that goes above and beyond on their financial, sustainability and personal goals – you’re with the right people!

365 finance in 2024, by numbers

We’ve explained why so many brokers choose to work with us, but we’re big believers in ‘show, not tell’, so let’s break down some of our achievements of the year based on the numbers.

Our funding

As of the start of 2024, there are 5.45 million small businesses in the UK (businesses with less than 50 employees), which account for 99.8% of the total business population. Although we can’t help every one of these businesses–even though we do try–things aren’t easy.

Accessing funding from traditional lenders has been more challenging than ever. In just five years, the success rate for SME bank loan applications dropped from 80% in 2018 to around 50%. As a whole, the success rate for all types of SME finance fell from 65% before the pandemic to a low of 45% in 2022.

Since 2021, challenger banks have exceeded the big five banks’ market share. The big five provided 63% of lending in 2014 but only 41% by 2023. Long approval processes and the high likelihood of being denied have forced small business owners to seek alternative funding.

At 365 finance, we have an average approval rate of 84%, making the chance of being approved for a loan from 365 finance is much higher than your traditional lenders. From the time of approval, our customers only have to wait, on average, 36 hours before they receive their funds – just 3 hours if it’s a renewal.

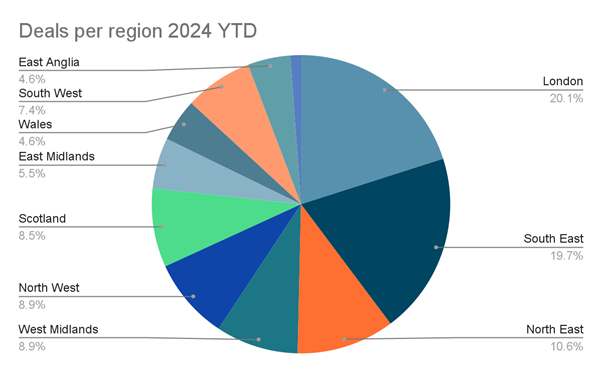

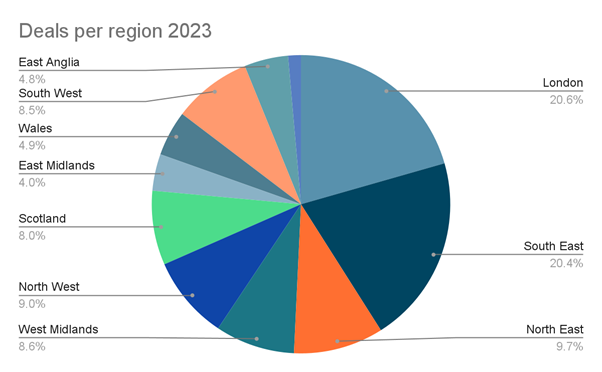

Lending by Region

Of the 4,117 deals made in 2024, around 40% went to businesses in London and the South East. This is hardly surprising as these areas have long been the most popular business hotspots, confirmed in a 2023 survey where London and the Southeast were found to be the top areas to fund a startup.

Source: 365 finance

Compared to 2023, we have increased funding across all regions of the UK except Northern Ireland (-0.09%) and the South West (-0.15%).

The regions with the most significant percentage increases in 365 finance funding were the North East and East Midlands, both of which saw higher percentage increases than London and the South East.

There is a general push to increase funding to areas outside of London. The Government’s Start Up Loans Programme has now seen 85% of their loans going to entrepreneurs outside of London. We hope to start building up our investments in a similar way so we can better support more of the UK’s important SMEs, regardless of location.

Lending by Sector

This year, we saw food retail as our most funded sector, making up 24.5% of our deals. This was followed by the following top sectors:

- Restaurant 21.7%

- Retail: non-food 16.2%

- Pub/bar 11.6%

Our top funding sectors remain unchanged compared to last year, but we have increased the amount of funding in these core sectors. Compared to 2023, we funded 22.7% more food retail deals, 25.9% more restaurant deals and 15.1% more pub/bar deals.

Outside of these top sectors, we have also provided funding to the following sectors this year:

- Hotel: 2.6%

- Garage/MOT: 5.6%

- Online: 5.6%

- Entertainment and leisure: 3.1%

- Professional/medical services: 2.4%

- Hair/beauty: 4.2%

- Other: 6.7%

While we are proud to provide efficient and essential funding to retail businesses–and will continue to provide as much funding as we can to these businesses in the new year–we also hope to increase our funding in other sectors.

Top deals of 2024

Out of the deals we’ve made this year, there have been some big funding successes that we are extremely proud of.

| Amount | Purpose | Split | Industry |

|---|---|---|---|

| £400,000 | New Site Completion | 10% | Health & Beauty Studio |

| £300,000 | Working Capital | 13% | Pub |

| £275,000 | New Branch Opening | 15% | Sandwich Shop |

| £220,000 | Refurbishment | 15% | Indoor Playground |

| £195,000 | Cashflow | 15% | Event Catering |

| £175,000 | Stock Purchase | 16% | IT Services |

| £170,000 | Summer Refurbishment | 11% | Pub Group |

Here are just some of our top deals of 2024, many of which wouldn’t have been possible without the work of our partners.

Looking Ahead to 2025

We’re proud to have made a real impact in 2024 through our partnerships with brokers. We’ve been able to help businesses across the UK, all while building lasting relationships with our partners.

And the journey doesn’t stop there! With award-winning customer service, a growing team, and innovative solutions, we’re excited to continue empowering SMEs in 2025 and beyond.

At 365 finance, we provide revenue-based funding of £10,000 to £400,000 in capital so your customers can thrive all year round. We collaborate with thousands of UK brokerages, providing unsecured finance solutions to small businesses – and market-beating commissions for you as an introducer.

To find out more, please contact a member of our partnerships team or head to our website.