Is The Regional Investment Zones Programme Helping Drive Funds to Key Businesses?

Written by Team 365 finance

When Chancellor Rachel Reeves presented the Autumn Budget 2024 in Parliament last month, many businesses and lenders were urged to ‘look at the positives’. Although we’re not here to pick apart the specifics of the announcement, one area that is of particular interest to us – and our brokers – is the continuation of regional investment zones.

These zones, which come as part of the increased Research and Development relief package, are designed to ‘create additional jobs and drive economic growth in areas that have economically underperformed in the past.” Particular zones mentioned in the newest budget were the East and West Midlands, with a focus on advanced manufacturing and green industries.

But what are these investment zones, and how can we, as players in the financial sector, help businesses navigate these changes and ensure key funds are being distributed effectively?

What Are Investment Zones?

The Regional Investment Zones Programme was put in place to help areas of the country with untapped potential and clear local strengths. The idea was to encourage collaboration between central and local government, with businesses and local partners to create an environment where innovation can flourish.

The programme focuses on 5 priority industries, and each investment zone should focus on supporting at least 1 of the following:

- Advanced manufacturing

- Creative industries

- Digital and tech

- Green industries

- Life sciences

The programme aims to nurture businesses in the country and provide easier access to relevant funds through a mixture of tax reliefs, business support, and planning mechanisms. Each zone will be provided with up to £160 million over 10 years, which will tie in with other tax reliefs announced in the Autumn Budget, including a permanent 40% business rates relief for retail, hospitality, and leisure sectors up to £110,000 and a Corporate Tax cap of 25%.

The current areas in England that were invited to develop Investment Zones and are expected to commence operation between 2024-2025 are:

- Greater Manchester Combined Authority (GMCA)

- Liverpool City Region Combined Authority (LCRCA)

- North East Combined Authority (NECA)

- South Yorkshire Mayoral Combined Authority (SYMCA)

- West Midlands Combined Authority (WMCA)

- West Yorkshire Combined Authority (WYCA)

- East Midlands Combined County Authority (EMCCA)

- Tees Valley Combined Authority (TVCA)

As the progress of these zones is yet to be communicated, although plans have been set, we will have to wait to see how much of an impact these additional funds and resources have in these particular areas.

Why Are Regional Investment Zones Important?

It may be no surprise to brokers that there is a large funding inequality across the UK. According to the Startups 100 Index, London startups receive eight times more funding than other businesses based outside of the capital.

In another report, it was found that the number of approved loans from small businesses fell by 9% across the country last year, with the North East seeing the largest decline. In total, the value of these loans also dropped by 18% nationwide.

However, one area that has managed to escape the downward trend is the South East, where lending increased by 10% last year and we saw a 21% increase in loan value, leading to a boost in economic activity in the region.

These figures are to be expected, considering the South East of England and London have the highest density of private businesses, accounting for 34% of the UK business population.

Regional Investment Zones aim to flatten the curve and create an environment where funds are allocated more equally across the country, creating jobs, boosting local economies, and encouraging innovation based on regional skills. Ultimately, small businesses and entrepreneurs should have access to the same level of support regardless of where they are located.

Although the impact is yet to be officially measured, there are signs that the introduction of these zones is already generating interest. In a survey of manufacturers, 3 in 4 said they would establish a business in an investment zone and 7 in 10 would invest more in their business if they were able to access business rates relief.

Regional Investing at 365 finance

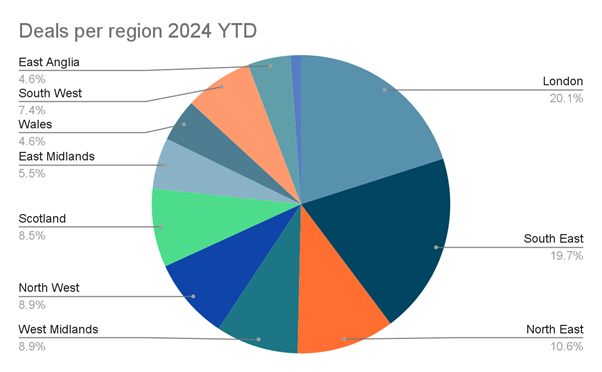

We’ve looked back at our deals throughout the year to see how we compare to the national average.

Source: 365 finance

The regions with the highest number of deals in 2024 for 365 finance have been London and the Southeast, making up almost 40% of our deals collectively.

However, we are also seeing high numbers of deals across the North and West Midlands, areas that have also been identified in the Regional Investment Zone Programme. The number of deals has also increased across the board compared to 2023 figures, providing more business owners with access to vital funds needed to grow their businesses.

Closing Thoughts

We are operating at a time when 61% of small businesses see market conditions as presenting more threats than opportunities. With a deep cost-of-living crisis, a tentative position for SME funding for women, and regional inequality, the finance industry will play an important role in supporting the work of Regional Investment Zones and creating a better environment for our small businesses.

As brokers, staying up to date with regional opportunities and information on investment zones is something you’re probably already doing. But, using this information to support clients can help us ensure that small businesses have access to the funds they need to thrive. Combined with revenue-based funding, we would hope the business environment for SMEs can rebuild itself over the next few years.

At 365 finance, we provide revenue-based funding of £10,000 to £400,000 in capital so your customers can thrive all year round. We collaborate with thousands of UK brokerages, providing unsecured finance solutions to small businesses – and market-beating commissions for you as an introducer.

To find out more, please contact a member of our partnerships team at partnerships@365finance.co.uk or head to our website.